what is fsa/hra eligible health care expenses

You can use your HSA or Health Care FSA to reimburse yourself for medical and dental expenses that qualify as federal income tax deductions whether or not they exceed the IRS minimum applied to these deductions under Section 213 d of the tax code. See more result.

Hra Vs Fsa See The Benefits Of Each Wex Inc

Claiming Reimbursement from a Flexible Spending Account best wwwhrupennedu.

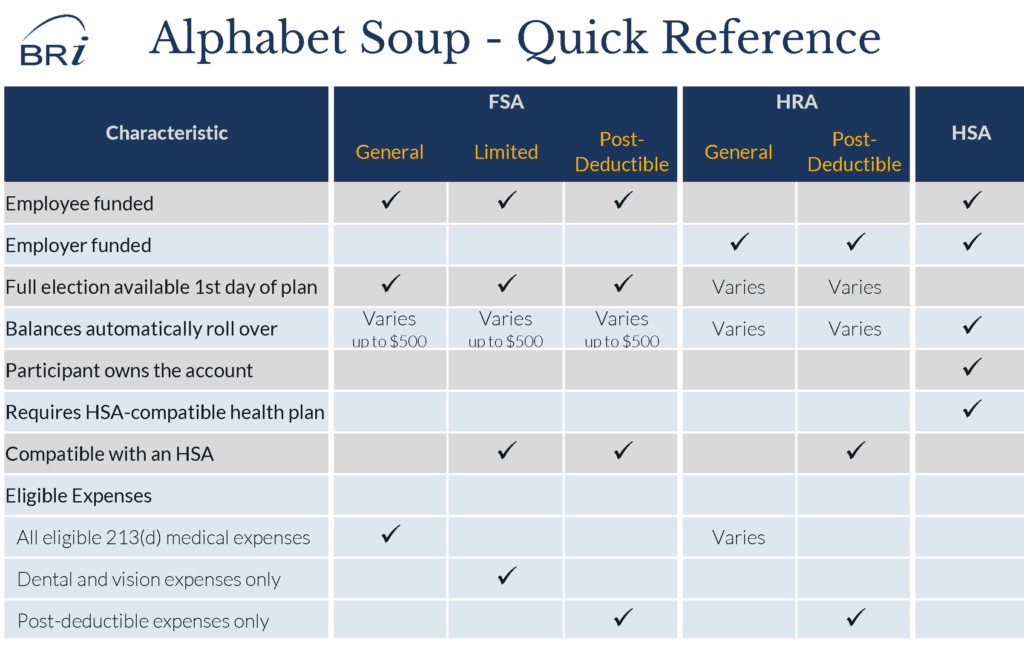

. Health savings accounts HSAs flexible spending accounts FSAs and health reimbursement arrangements HRAs are companion benefits employers can offer to empower their employees to save money on health care expenses. The IRS may request. Using tax-free dollars to pay for eligible expenses saves up to 30 meaning a 100 eligible expense costs you about 70.

You dont pay taxes on this money. Refer to your plan documents for more details. An HRA is funded solely by the employer and the reimbursements for medical expenses up to a maximum dollar amount for a coverage period arent included in your income.

In some ways a health reimbursement account or HRA is similar. Employers can choose to exclude categories of expenses ie prescriptions as long as the exclusion is applied fairly to everyone. Eligible Expenses As of January 1 2020 over-the-counter OTC medicines as well as feminine care products are eligible for tax advantaged benefit plans such as FSAs HRAs and HSAs without a prescription or physicians note.

Your employer determines which expenses are eligible for reimbursement based on a. Includes various items that assist individuals in performing. Heres a pretty comprehensive list of what counts as qualified expenses.

HRA Eligible Expenses Table Eligible Expenses You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. An HRA is an employer-funded plan that reimburses employees for medical care expenses and allows unused amounts to be carried forward. Employers can offer one of these benefits or combine multiple benefits to maximize tax savings.

Specifically the cost of menstrual care products is now reimbursable. This means youll save an amount equal to the taxes you would have paid on the money you set aside. But because HRAs are only funded by your employer you cant take your HRA with you if you change jobs it belongs to your employer.

If you have a health plan through an employer a flexible spending account FSA is a tool offered by many employers as part of their overall benefits package. Please save your receipts and other supporting documentation related to your HC FSA expenses and claims. Employers make the plan contributions and funds can be used to pay for qualified healthcare expenses.

Your employer determines which health care expenses are eligible under your HRA. Your employer determines which health care expenses are eligible under an HRA. Flexible spending accounts FSAs and health savings accounts HSAs help you save money because the contributions you make to the account are exempt from Federal State and FICA payroll taxes.

HSAs are usually only available to people who have a high-deductible health plan and are tax-exempt meaning money goes in tax-free comes out tax-free and can earn. Hsn Hair Care Blank Deed Pdf. A health savings account HSA and a flexible spending account FSA are both tax-advantaged accounts that allow you to save specifically for certain medical or wellness expenses.

There are two different types of FSAs. Generally qualified expenses include doctor visits medications medical equipment and dental and vision care for you. Health Savings Accounts HSAs Health Flexible Savings Accounts FSAs and Health Reimbursement Arrangements HRAs are all tax-advantaged so the IRS defines the types of expenses that you can pay for with these accounts.

Contributions can be written off for the employer and can be used tax-free for the plan participants. As long as you have money in your HRA you can use it to help pay for qualified out-of-pocket medical expenses. Medical FSA HRA HSA.

Expansion of qualified medical expenses The CARES Act also modifies the rules that apply to various tax-advantaged accounts HSAs Archer MSAs Health FSAs and HRAs so that additional items are qualified medical expenses that may be reimbursed from those accounts. 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

HRA - You can use your HRA to pay for eligible medical dental or vision expenses for yourself or your dependents enrolled in the HRA. Health Care Flexible Spending Claim - Mail Health care FSA claims MMSI 4001 41st Street NW Rochester MN 55901-8901 Intraclinic Mailing Address Mayo Support Center North Keywords health care flexible spending claim mc1090-13 expenses plan account More. Health reimbursement arrangement HRA.

One for health and medical expenses and one for dependent carechildcare expenses. The IRS determines which expenses can be reimbursed by an FSA. An HRA is an employer-owned account that can be paired with any type of health plan.

The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements health FSAs health savings accounts HSAs health reimbursement arrangements HRAs or Archer medical savings accounts Archer MSAs. Eligible expenses include doctor visits copays dental cleanings prescriptions eye glasses diabetes supplies etc. A health reimbursement account HRA is a fund of money in an account that your employer owns.

List Of Hsa Health Fsa And Hra Eligible Expenses

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

List Of Hsa Health Fsa And Hra Eligible Expenses

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Hras Are One Of The Tax Favored Health Plans That Employers Can Offer Their Employees Some Others That E Health Savings Account Savings Account Finance Saving